NFTs, or Non-Fungible Tokens, are unique digital assets recorded on the blockchain. Their irreplaceability and immutability lend them high security, safeguarding against theft and fraud. In 2021, NFTs were hailed as the word of the year by Collins Dictionary. According to GlobalData’s chief analyst, Steven Schuchart, NFTs represent a form of social currency born from the desire to leverage blockchain for more than just cryptocurrency.Â

The allure of NFTs lies in their uniqueness and security, representing anything from digital artwork and music to videos and in-game items. Since NFTs cannot be replicated or altered, they ensure that creators and buyers maintain ownership of their assets.Â

The Rise of NFTs: From Niche Interest to Mainstream Frenzy

The history of NFTs dates back to 2014 when Kevin McCoy created the first NFT, “Quantum,” on the Namecoin blockchain. However, the industry didn’t gain significant attention until between 2018 and 2021. During this period, the market grew 60-fold, fueled by the interest of young, wealthy celebrities, influencers, and artists in the emerging scene. In March 2021, artist Mike Winkelmann, also known as Beeple, sold his NFT work “Everyday” for a record-breaking $69 million at Christie’s auction house. This sale became a global headline, catapulting NFTs into mainstream consciousness.Â

According to NonFungible.com, the NFT market experienced explosive growth in 2021, with sales reaching $17.6 billion, a 21,000% increase from $82 million in 2020. This growth was driven by several factors:

- The surge in cryptocurrency prices created capital for speculative investment in emerging digital assets.

- Recognition and launches of NFTs by well-known artists and celebrities.

- Major auction houses and galleries began treating NFTs as a form of art.

- Social media influencers and cryptocurrency investors promoted NFTs to retail investors.

- NFT marketplaces became more user-friendly, even for tech novices.Â

In the months following Beeple’s landmark auction, NFT transaction volumes soared from millions to billions of dollars per month. The term “NFT” entered dictionaries, with search volumes surpassing those of “cryptocurrency” and “Bitcoin.” With companies like Nike, Gucci, and Tiffany entering the field, NFTs seemed unstoppable. In 2022, NFTs continued to dominate, transforming the art world and creating overnight millionaires and “richest living artists.”

The Pivot of NFTs: From Hype to Rationalization

The NFT market experienced explosive growth in 2021, with sales reaching $17.6 billion, a staggering increase from the previous year. This growth was fueled by a confluence of factors, including the surge in cryptocurrency prices, the endorsement by celebrities, and the recognition of NFTs as a legitimate form of art by major auction houses. However, the journey was not without its challenges. In 2022, the NFT market faced a downturn due to cryptocurrency price crashes, fraud and security risks, and limited practical applications.

Fasthosts’ Internet Status Report explored the trends of the .nft domain name.

- In January 2021, the search term “.nft” was 138% more popular than the average, dominating headlines.

- The top-level domain .nft was the world’s second most popular domain for 10 months out of 12 in 2022, alongside other hot domains like .eth, .coin, and .crypto.

- In August of the same year, the domain name .nfts.com sold for an astonishing $15 million, becoming one of the largest public domain transactions ever.Â

At that time, the global NFT market was valued at $11.3 billion, covering a variety of collectibles such as artwork, virtual universe tokens, and gaming collectibles. Artists flocked to this new medium, attracted by the potential to sell digital art directly to buyers. Digital tokens started being accepted across different social media platforms and businesses. In this market space, major brands and sports figures like Christiano Ronaldo signed agreements, and even Donald Trump expanded his NFT collection.

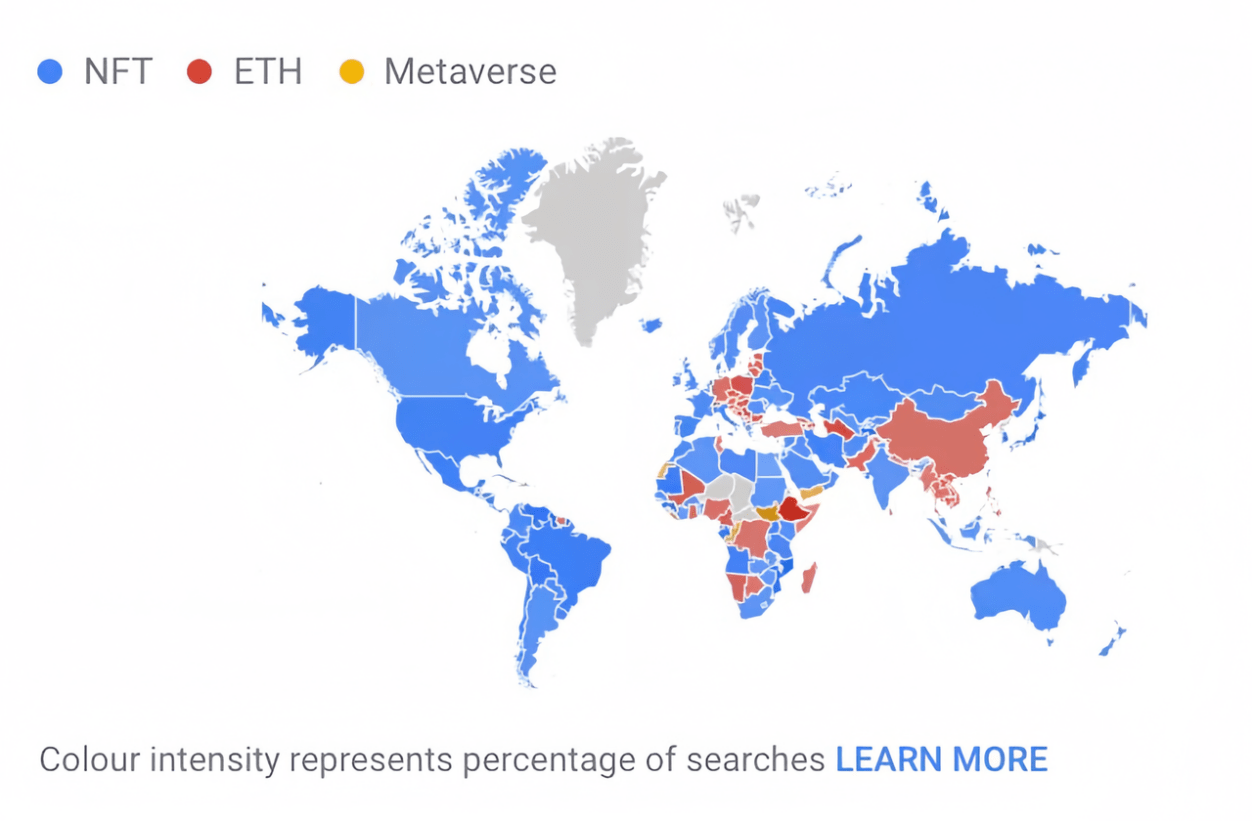

The global interest in the NFT ecosystem can also be glimpsed through Google search volumes for NFTs, which surpassed ETH and the Metaverse, peaking at the end of 2021. The trend indicated that NFT popularity was set to continue rising in 2022.

Relative search volumes for ‘NFT’, ‘ETH’, and ‘Metaverse’ on Google – Global statistics for 2021Â

From 2021 to 2022, NFTs appeared to be at the forefront of the digital world. However, in 2022, the NFT market experienced a downturn due to various factors:

- The crash in cryptocurrency prices: In February 2022, Russia’s invasion of Ukraine caused turmoil in global financial markets, leading to a plummet in cryptocurrency prices. As a digital asset, NFTs were also affected.

- Fraud and security risks in the NFT space: Early in 2022, OpenSea, the largest NFT marketplace, admitted to insider trading on its platform, damaging the industry’s reputation. Furthermore, phishing attacks and scams in the NFT space led to decreased investor confidence.

- The practical applications of NFTs remained limited: Although innovative, the real-world applications of NFTs were still being explored. Currently, NFTs are mainly used for art, gaming items, etc., with limited application in other areas.

- Due to these factors, the NFT market saw a significant downturn in 2022. According to a NonFungible report, the third quarter of 2022 saw a 77% drop in transaction value in dollars, with net losses reaching $450 million for the first time.Â

2023 saw signs of vitality within the NFT market. The industry began to adapt, with creators, platforms, and buyers adopting a more cautious and regulated approach. High-value corporations and brands continued to explore NFTs, expanding their applications beyond traditional domains. This resurgence underscores the market’s transition from initial exuberance to a more mature phase, highlighting the enduring potential of NFTs to innovate and reshape the digital world.Â

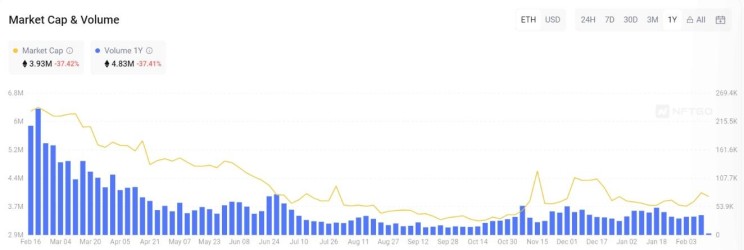

In 2023, the NFT market showed signs of vitality. Despite a smaller scale, there was still significant sales activity in the NFT market. According to NFTGo data, the transaction volume in 2023 was about 4.83 million ETH, a roughly 37% decrease year-over-year, with the highest transactions in the first quarter and a gradual decline afterward.

On the other hand, participants in the NFT space began to learn from past lessons, taking measures to improve the market environment. Creators recognized the importance of their content, platforms and markets started implementing stricter regulations, and buyers became more cautious before investing. Additionally, high-value corporations continued to pivot towards NFTs, with renowned brands like the English Premier League, Louis Vuitton, Sony, and McDonald’s entering the space. NFT applications also expanded into other areas such as financial loans and air travel.Â

By the end of 2023, the NFT market was heating up again, with major NFT brands expanding into physical stores and e-commerce, and many well-known companies actively entering the NFT space. The investment in creating AAA blockchain games was also set to debut. This trend indicates that the construction and development of NFT brands will become an important driver for pushing the Web3 industry in 2024.

Thus, in 2024, we can expect to see more NFT products characterized by being small-scale, diverse, affordable, highly prevalent, and blending virtual with real, enabling consumers to participate in the NFT domain and Web3 ecosystem in a simple, inexpensive manner.

The evolution of NFTs reflects the market’s transition from initial exuberance to a more mature phase. Despite facing challenges, the potential of NFTs as an emerging technology has not vanished. Future developments may bring new opportunities as technology innovation, application scenarios expand, and market participants reassess risks and values.

Amidst this evolving landscape, ChainUp has emerged as a key player in the NFT product space. ChainUp specializes in blockchain technology solutions, offering a comprehensive suite of services that cater to the burgeoning demand for NFTs. Their platform is designed to streamline the creation, management, and sale of NFTs, making it accessible for creators and investors alike. By focusing on user experience, security, and integration with existing blockchain ecosystems, ChainUp provides a robust foundation for the development and expansion of NFT markets.

ChainUp’s innovative approach also includes the development of customized NFT marketplaces, enabling brands and creators to launch their own NFT collections with ease. Their solutions are tailored to meet the diverse needs of the NFT community, from art and entertainment to gaming and beyond. With a commitment to fostering growth and innovation within the NFT space, ChainUp is at the forefront of driving the Web3 industry forward into 2024 and beyond.