Are NFTs (non-fungible tokens like the popular Bored Ape artwork) securities? The Securities and Exchange Commission’s first enforcement decision against an NFT would have you believe they are. But in the analog world, digital assets such as NFTs don’t fit cleanly into existing boxes for what is and what isn’t a security regulated by the SEC.

The August enforcement action hints at when and how the SEC will likely regulate NFTs in the future, and is likely only the opening salvo in a larger enforcement campaign against NFTs. NFT offerings that function as securities for investors will need to be registered or satisfy an exemption to avoid coming within the SEC’s crosshairs. Other regulators, such as states and foreign jurisdictions, are also proceeding apace with regulating cypto tokens and digital assets, such as NFTs.

SEC to Impact Theory: Your NFT Is a Security

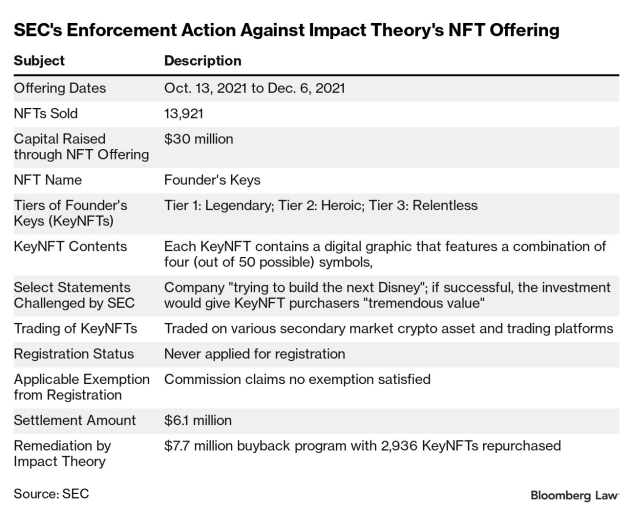

The SEC’s enforcement action (and subsequent $6.1 million settlement) against Impact Theory LLC’s NFT offering claimed that the media and entertainment company’s sale of NFTs amounted to an offering of unregistered securities. Impact Theory raised about $30 million from several hundred investors, telling them that the capital raised would be put toward building its entertainment business.

The securities laws prohibit unregistered offerings of securities, absent a registration exemption—which Impact Theory never obtained.

The Commission’s majority reached this conclusion by applying the US Supreme Court’s Howey test, which says that a security is “an investment of money in a common enterprise with profits to come solely from the efforts of others.”

The Dissent’s Nine Questions to Better Regulate NFTs

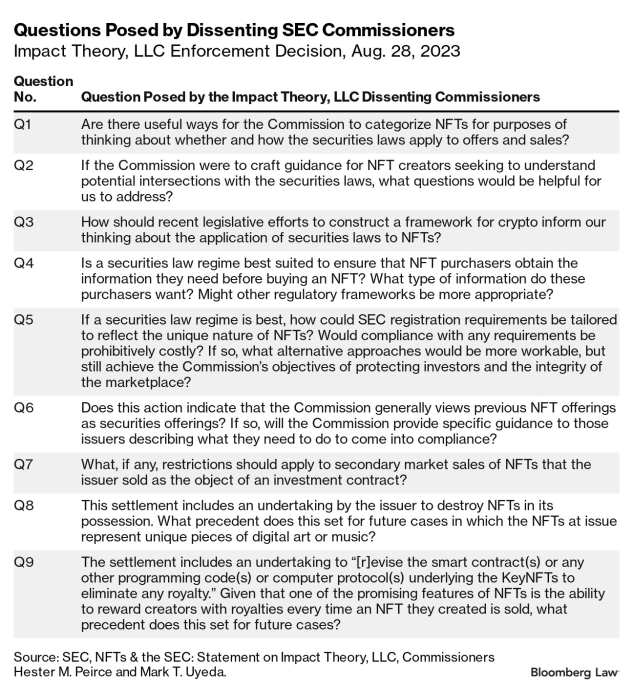

Two of the SEC’s five commissioners dissented from the landmark Impact Theory decision, finding that the company’s promotional statements failed to rise to the level requiring regulation by the SEC. They presented nine thought-provoking questions for their fellow commissioners, the discussion of which they believe might help the SEC better regulate amorphous NFTs.

The questions call on the Commission to be more proactive in setting guardrails for the sale of NFTs, rather than continue relying on a case-by-case, regulation-by-enforcement approach, which makes it challenging for lawyers advising NFT clients on how to avoid legal trouble.

Question 1, regarding how to categorize NFTs, provides a strong clue as to the possible SEC regulation of NFTs.

How Will the SEC Categorize NFTs?

It’s particularly difficult to pin down what NFTs are, and properly categorizing instruments is essential to fair and effective regulation. One helpful way to think about them, and to appreciate their versatility, is NFTs are digital certificates of authenticity which represent ownership in an underlying asset. They create on an open blockchain a unique identifier that makes it possible for NFTs to hold significant value. Otherwise, something that is digital could be infinitely reproduced exactly like the original, making the value of the original extremely limited. NFTs solve this problem for digital artists and other creators by verifying authenticity and thereby creating scarcity (and, their creators hope, added perceived value).

NFTs are unique and come in a variety of forms. NFTs aren’t limited to digital art ownership. They can be physical objects, including sports collectibles or a music album. They can also be non-artistic, such as Walmart’s NFT development for managing its supply chain. NFTs’ possible uses are many and wide-ranging but at its core, an NFT protects the ownership of a unique creation. The value of an NFT depends on its scarcity and popularity.

The critical securities regulatory issue in evaluating an investment instrument isn’t what it’s called or how it’s packaged. What matters is its function. Is money solicited from investors for a common enterprise with the expectation of profits through the efforts of others? Or, to state it more concretely: Is an investor buying a piece of digital art or are they principally investing in a business?

The investor’s expectation of what they will be receiving in return for their money can be determinative. It’s why a stock certificate evidencing ownership in the Green Bay Packers football team isn’t a security (it functions as a novelty or collectible; an investor has no expectation of profit), and an investment in an orange grove can be a security rather than merely a real estate investment (facts of the Howey case). It’s also why Meta’s abandoned stablecoin Diem (originally Libra) was carefully structured not to raise capital to build out the coin’s infrastructure (Howey’s “common enterprise”) and why the SEC gives fully realized (“sufficiently decentralized”) cryptocurrencies Bitcoin and Ether a free pass.

Based on the Impact Theory decision, one would anticipate that the SEC will be highly likely to continue keying in on statements made to investors to entice them to invest and into how that investment money was used by a company being investigated. How a company creating NFTs for an offering handles those two factors will probably determine whether the SEC sees their NFT as a security.

This is borne out by the agency’s second NFT-enforcement settlement against Stoner Cats 2 LLC in September. The Commission—again in a 3-2 split decision—focused on investor expectations and how the investment money was used. Investors were given reasons to believe that they would profit from their investment, and they knew their money would go towards producing an animated web series to be called “Stoner Cats.”

The show wasn’t complete when investors were solicited and NFTs were sold. The show needed the capital from those NFT investments to fund the project through to its completion. When those two factors (profit expectation and funds used as business capital) are found in combination, this Commission will likely always find that the NFT at issue is an unregistered security.

The SEC Wants to Regulate NFTs

A majority of the Commissioners want NFT regulation to be recognized as within the SEC’s purview, and it will likely fight to apply the current securities regime to NFTs when issuers offer NFTs to raise money to build the businesses and when the promoters make promises that investors will profit.

Access additional analyses from our Bloomberg Law 2024 series here, covering trends in Litigation, Transactions & Contracts, Artificial Intelligence, Regulatory & Compliance, and the Practice of Law.

Bloomberg Law subscribers can find related content on our Practical Guidance: Production and Sales Agreements resource.

If you’re reading this on the Bloomberg Terminal, please run BLAW OUT <GO> in order to access the hyperlinked content, or click here to view the web version of this article.